If the past several years have taught us anything, it’s that we never know what’s coming around the corner. Whether it’s shifting economic conditions, surging inflation, a pandemic, emerging technology, talent shortages, or cyber threats.

In light of these challenges, the future of finance is all about driving innovation with emerging technologies, building the right combination of capabilities, establishing a strong data foundation and managing across functions

As we step into 2025, we see a demanding year for CFOs. They will be seen as strategic leaders driving innovation, resilience, and growth. Here are key trends that we think CFOs should focus on to become forward-thinking CFOs.

Top 5 Finance Trends and Priorities for CFOs in 2025

FinAdvantage began in 2013, with a vision to offer more than traditional accounting services. The founders— Hitesh Shah, Amith Shah, Sundeep Mittal, and Gopal Sharma—were seasoned chartered accountants (CAs) who saw the limitations of large, traditional accounting firms. Despite their success at a big-four accounting firm, they recognised that many businesses were underserved in terms of personalized, value-added services that could help them thrive in today’s complex financial landscape.

1. Digital Transformation Beyond Automation

Digital transformation remains a top priority for CFOs in 2025, but we see the focus shifting from mere automation to leveraging advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and blockchain to drive strategic outcomes.

- AI and Predictive Analytics: AI is reshaping financial operations by enabling real-time data analysis, predictive forecasting, and decision-making. For instance, AI-driven tools can optimize cash flow management or detect fraud with unparalleled precision.

- Blockchain for Transparency: Blockchain technology is gaining traction for enhancing transparency in financial transactions and ensuring compliance with regulatory standards.

- Real-Time Financial Insights: The need for on-demand reporting is pushing CFOs to invest in systems that provide real-time insights. This agility allows organizations to respond swiftly to market changes.

FYI: A Gartner report highlights that 69% of business leaders expect digital technologies to transform their industries by 2026. For CFOs, this means integrating these tools into day-to-day operations to enhance efficiency.

2. Financial Resilience and Risk Management

The economic uncertainties of recent years have underscored the importance of financial resilience. In 2025, CFOs need to prioritize high-level strategies that safeguard their organizations against disruptions while enabling growth.

- Cybersecurity: With cyberattacks costing businesses an average of $4.9 million per breach in 2024, cybersecurity has become a critical area of focus. CFOs need to implement robust data protection measures to safeguard sensitive business information.

- Regulatory Compliance: The evolving regulatory landscape demands sophisticated compliance strategies. Leveraging AI to automate compliance processes can reduce risks and enhance accuracy.

- Scenario Planning: Advanced modelling tools can prove to be a boon for CFOs in identifying potential opportunities and risks by simulating various economic scenarios.

We believe that the top priority for CFOs in 2025 would be to build agile financial models that can adapt to changes. This could mean, implementing frameworks that can reimagine their operations, products and processes.

3. ESG Integration

Environmental, Social, and Governance (ESG) factors have moved from being a corporate buzzword to a critical component of financial strategy. In 2025, CFOs are expected to lead sustainability efforts while balancing profitability

- Sustainability Reporting: With regulations like the EU’s Corporate Sustainability Reporting Directive coming into effect, CFOs must ensure accurate and transparent ESG disclosures

- Green Investments: Companies are increasingly aligning their investment strategies with sustainability goals. CFOs play a pivotal role in evaluating the ROI of such initiatives.

- Ethical Finance: Beyond compliance, there is growing pressure from stakeholders for ethical financial practices that prioritize long-term societal benefits over short-term gains.

According to a survey, over two-thirds of CFOs are now responsible for ESG compliance and reporting—a trend that highlights the expanding scope of CFO’s role.

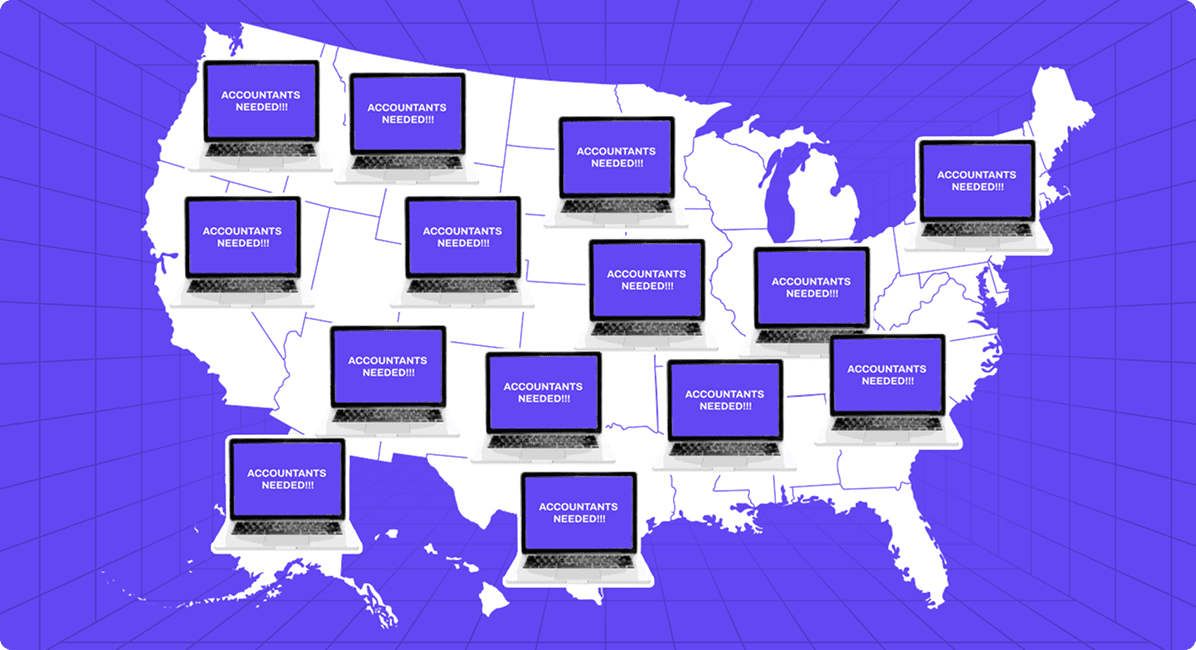

4. Talent Management and Upskilling

Environmental, Social, and Governance (ESG) factors have moved from being a corporate buzzword to a critical component of financial strategy. In 2025, CFOs are expected to lead sustainability efforts while balancing profitability

- Upskilling Teams: Organizations need to invest heavily in training programs to equip finance professionals with digital skills like data analytics and AI application.

- Attracting Tech-Savvy Talent: With 77% of CFOs admitting that lack of technical skills within finance is a major reason for not embracing AI in the field, it is more important than ever to recruit tech-savvy talent.

- Hybrid Skills Demand: By 2027, Gartner predicts that half of finance staff will need hybrid skills combining financial expertise with technological proficiency.

Building a future-ready team requires not just technical training but also fostering a culture of continuous learning and adaptability within the finance function.

5. Accepting Bigger Challenges

The role of the CFO is no longer confined to traditional financial management; it now encompasses enterprise-wide responsibilities such as digital transformation leadership, stakeholder engagement, and cross-functional collaboration.

As our Co-founder and Chief of Global Markets,

Hitesh Shah rightly says,

“The finance function is no longer about crunching numbers; it’s about delivering actionable insights that drive business strategy.”

- Data Stewardship: As custodians of organizational data, it is CFOs primary responsibility to lead D&A governance practices to ensure data quality.

- Collaboration Across C-Suite: CFOs will be able to address cross-functional challenges effectively by partnering with CIOs, CHROs, and sustainability officers.

- Driving M&A Activity: As we can see that the market conditions are improving slightly in 2025, CFOs need to explore strategic mergers and acquisitions as a pathway to growth.

This expanded role requires CFOs to adopt a holistic view of business operations while maintaining their core financial responsibilities.

Conclusion

The year 2025 presents both challenges and opportunities for CFOs as they navigate an increasingly complex business environment. From embracing cutting-edge technologies to leading sustainability efforts and managing talent gaps, the expectations placed on finance leaders have never been higher.

The priorities outlined above reflect not just trends but also imperatives that will define successful financial leadership in the years ahead. Focusing on these areas will help CFOs position their organizations for sustainable growth, operational excellence, and long-term resilience—solidifying their role as indispensable strategic partners in the C-suite.